Market Overview

Wheat / Barley / Maize

Following the WASDE report published by the USDA on Tuesday, the general reaction was a bullish report for Wheat.

Global Wheat supplies are estimated to decline by 7.2MT. This is due to downward revisions to production on Major exporters such as Australia (-3MT), Canada (-2MT), Argentina (-1MT) and the EU (-1MT).

Global Wheat production is now estimated at 787.3MT, down 6MT from the August report. Global Ending Stocks for Wheat are not projected at 258.6MT, the lowest since 2015/2016.

Cheap wheat from Russia and Ukraine continue to pressure EU markets despite the cuts to global production.

UK Feed Wheat quality in the South West has come under some pressure compared to other areas. The GB average is currently 73 – 75 kg/hl, however in the South West, due to the adverse weather conditions seen in the build up to harvest, a proportion of crops are reported as only just meeting specification. The average GB winter wheat yield for all crops harvested to date is estimated at 7.8 – 8.2 t/ha, which is currently sitting around the five-year average.

The discount of Barley to wheat has narrowed to -£8/T. Winter Barley yields and quality are reported as good, sitting along the five year average. However Spring Barley yields and quality have been variable. UK Barley sales have been reported as quiet as farmers are reluctant to sell at the current market value.

Following the WASDE report, the outlook for US Maize production was increased due to higher acreage, outweighing the downward yield revisions. The US crop is now estimated at 384.4MT, close behind the record crop seen in 2016/2017.

The US Maize harvest is now at 5% complete. Global Maize production is now estimated at 1,214.3MT, up 5% from last year. If expected South American supplies come into the market in 2024, this could pressure markets further.

Hi Pro Soya / Rapemeal

Due to US Soybean yields falling and planted area remaining unchanged, US Soybean production estimates have fallen to 112.8MT from August’s estimate of 114.5MT.

US ending stocks remain tight, meaning a reliance on a bumper South American crop. 2023/2024 estimates have Brazil Soybean production at 163MT, up from 2022/2023 estimates of 156MT. Argentina are expected to increase their 2023/2024 production with estimates at 48MT compared to 25MT last season.

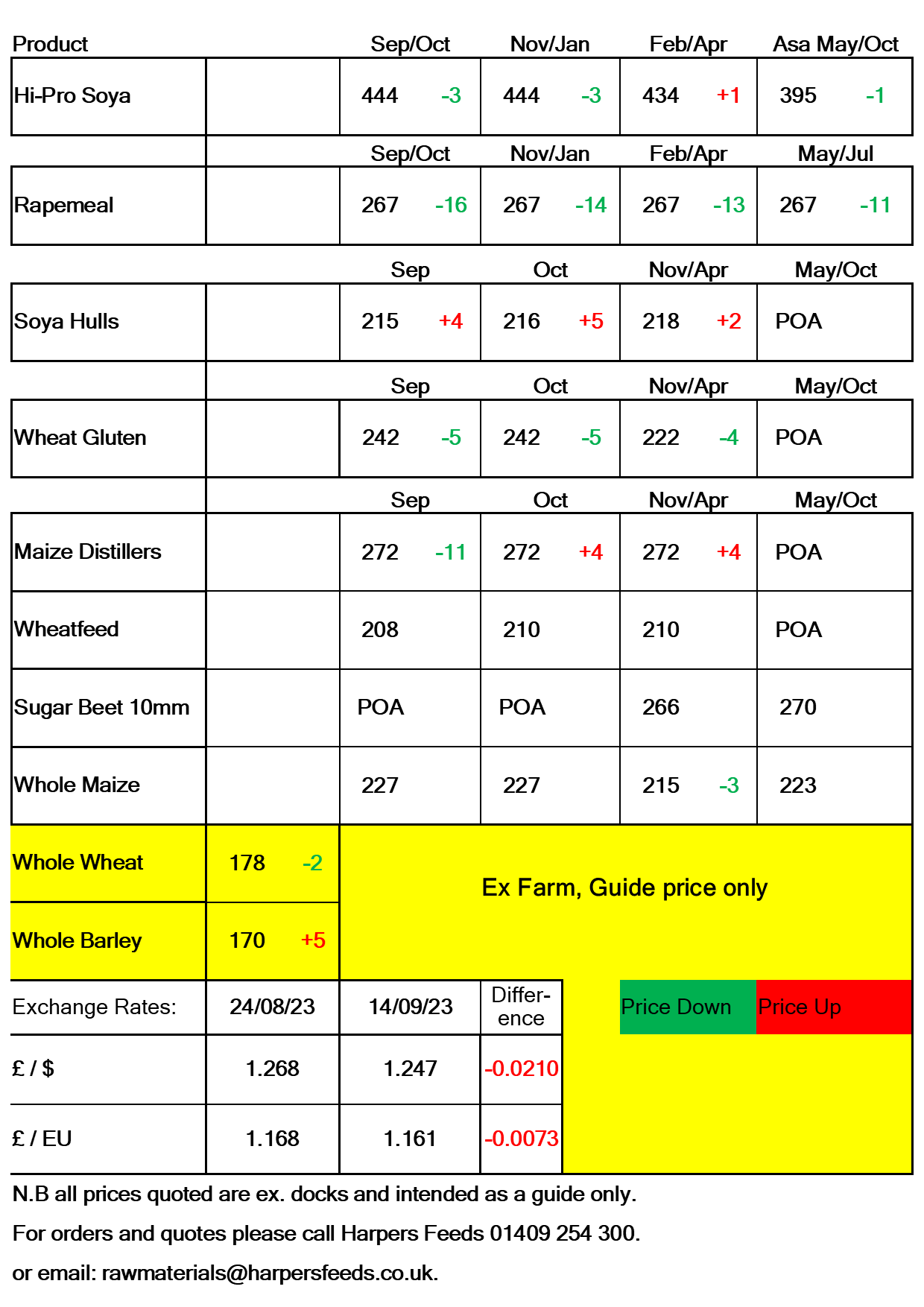

A key watchpoint for domestic Soybean prices will be the strength of the pound against the US dollar. GBP vs USD is currently trading at 1.25. In July figures reached 1.31. If the pound gains strength in the coming weeks, domestic soybean prices would come under pressure.

Decent old crop carry over for rapeseed and increases to Ukraine crops have pressured global prices. World rapeseed supplies remain well stocked at 86MT. However reports suggest the Canadian crop at 17.5MT, the second lowest in nine years. Australia are also projected to see a decrease on production by up to -38%. If realised, global prices could find support.