The new strain of the coronavirus, Omicron, has caused concerns amongst many as travel restrictions have been reintroduced in the UK and fears are growing that the new strain will have an impact on the ongoing logistical issues relating to freight, haulage and imports.

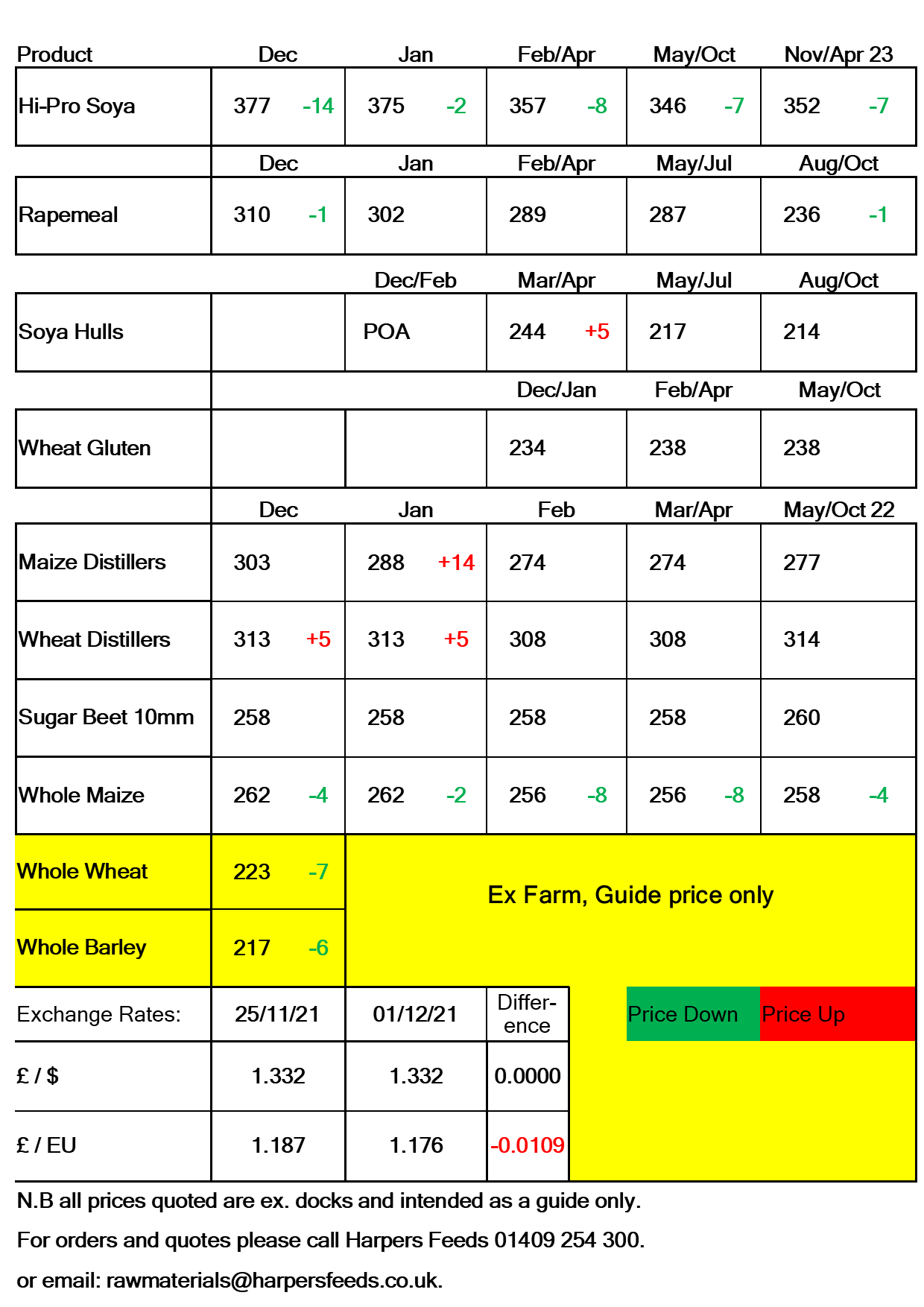

Global grain prices eased from the back of the mid-week highs of last week due to reduced trade as markets closed for the Thanksgiving holiday and new worries of the Omicron variant grew.

Other factors that weighed in on the market were signs of a stabilising US crop rating and Australia revising its official estimate for the 2021/2022 crop to a record 34.4 million tonnes.

However, one issue that could slow the ease in the UK market is an ever growing strong demand for European Wheat, which could persist given that Russian export tax is set to rise again this week. Domestic wheat supply and demand remains tight with lower imports forecast for this month while demand continues to grow.

Soybean prices have also eased due to the sharp rise drop in the crude oil market. Supported by reports of good weather for crop development in South Africa the two factors added pressure on prices. The impact of the new covid variant was also a contributing factor but for how long this will take effect is unknown. Soya could well be worth a conversation regarding cover if we continue to see prices ease further for the spring/summer period.

Global rapeseed supplies remain tight this year. If we see more positive news in the soybean market we may see the rise in rapeseed prices slow and potentially ease.

As we move towards the end of 2021 we expect to see the current volatile market to continue into 2022.