Market Overview

London Wheat May Futures closed at another record high on Tuesday, closing at £332/tonne for May. With no end in sight to the Russia-Ukraine war, the possibility of a global wheat shortage becomes a growing concern. The two countries account for 28.3% of global trade.

With a combined Good & Excellent rating of just 30%, US crop conditions are marginally worse than in 2018 and the short term weather outlook continues to be a concern for US winter wheat.

The domestic market looks to remain tight with tight supply and strong demand. UK crops in the ground do look to be in good condition, yet the domestic market is following the global market very closely and there is little to indicate for an ease in domestic wheat prices.

For Barley, the ongoing tight supply and demand situation will result in barley prices continuing to track wheat values very closely.

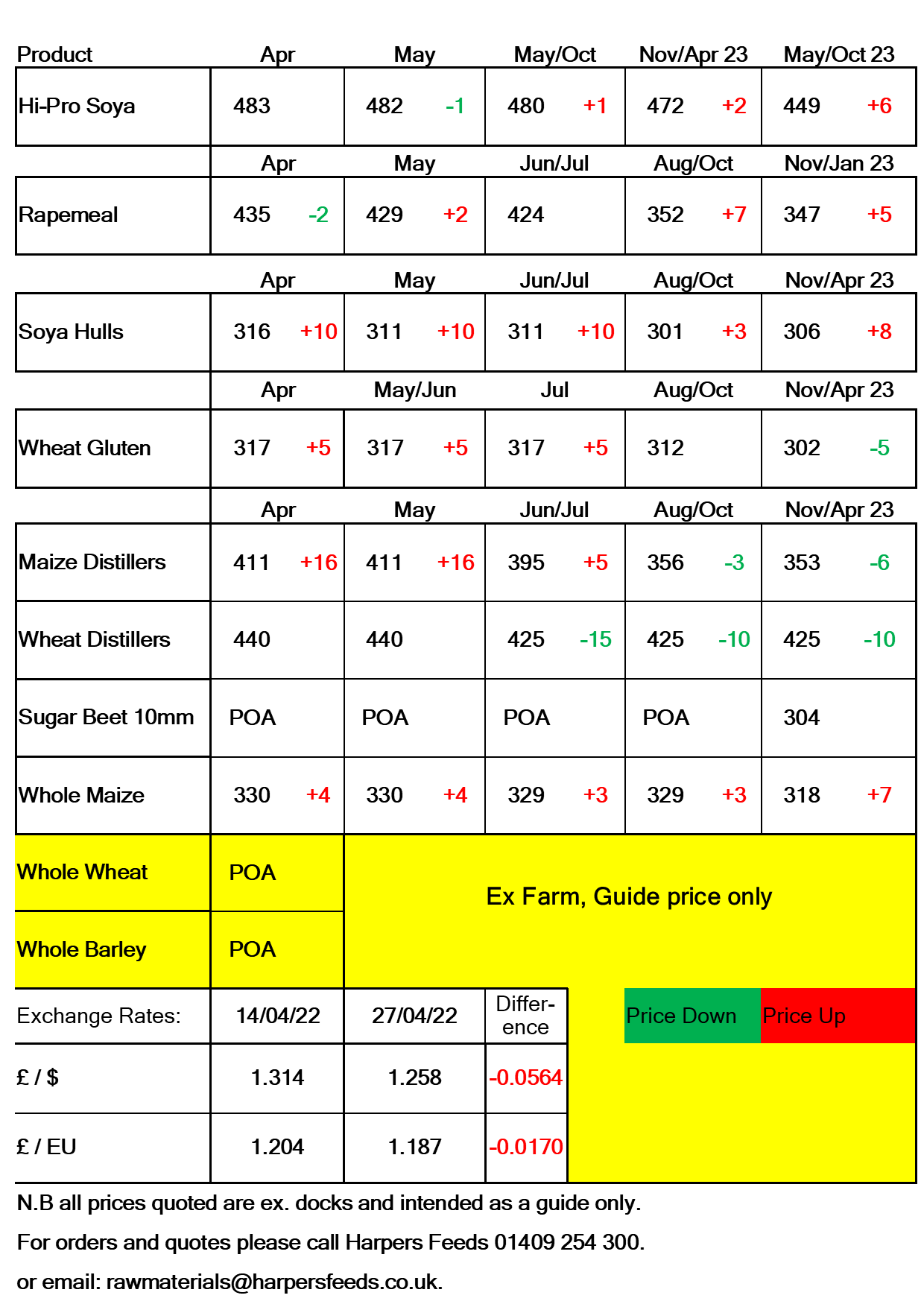

Rapeseed markets are expecting stocks to remain tight into the 2022/23 season, with new crop rapeseed continuing to trend higher and closing the gap on old crop. While there is conflict between Russia and Ukraine, markets will continue to price in the risks to supply next season. The supply risks to sunflower are compounding the supply risks, with replacement needs driving additional demand to rapeseed.

Old crop US soybean export sales are still tightening markets as they continue to push above the revised full season USDA export estimate. With a drought impacted Brazilian crop, additional demand for US soybeans is to be expected.

The Brazilian soybean harvest continued to record disappointing yields as the harvest enters its final stage. Some areas were found to be 50% down from expectations. With a drought impacted Brazilian crop and tight US stocks, there remains plenty of reason to expect volatility for global prices.