Market Overview

Last week saw global and domestic wheat prices enter a period of volatility.

May 23 UK feed wheat futures began the week trading at £201.50/T and by Thursday’s close, it was trading at £191/T. This was the first time since February 2022 that the UK wheat futures had traded below £200/T.

There were many factors that were attributed to the pressure on global prices. The first being the renewal of the Black Sea Export Corridor. The new deal will now last for 60 days with the next renewal deadline on 18th May 2023. Despite the shorter agreement, the news put grain prices under pressure.

Cheap and abundant wheat supplied from Russia and Australia continued to have an impact on global prices.

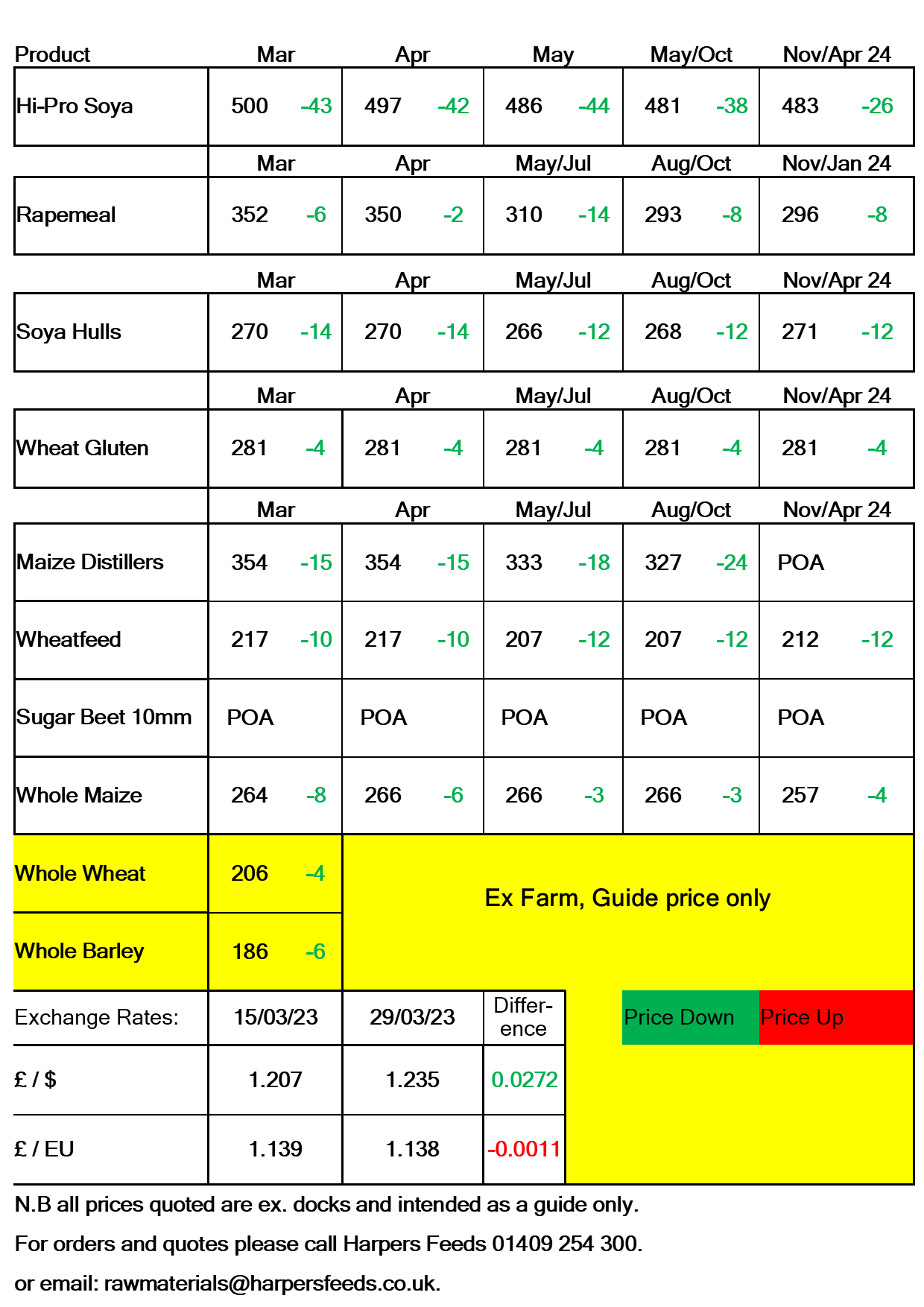

Currency has also had an impact on UK prices as the Pound and Euro gained 3% against the US Dollar. The global economic woes caused the banks and traders to enter a sudden period of widespread selloff on Wednesday.

Since Friday however, prices have rebounded, and UK feed wheat is currently trading at £210/T.

Reports that Russia planned to halt wheat and sunseed exports emerged on Friday. Initially this gave support to grain markets. The reports have since been dismissed by the Russian Government, stating they wanted to ensure fair prices for growers to cover cost of production. Now support has come from the uncertainty around the future of the Black Sea Export Corridor. Russia have heavily implied that that western sanctions imposed on them would need to be removed to ensure the continuation of the deal beyond the 18th May.

Recent surveys have shown that Ukraine’s wheat and maize production is likely to be down by 40%. Estimates suggest that Ukraine’s maize crop production for this year will be 18MT compared to 27MT in 2022 and 42MT in 2021.

China has been back in the market purchasing 1.2MT of US maize last week. With this years Argentinian maize crop severely impacted by ongoing drought, it is also thought that the US will remain the main supplier for China until Brazil’s second crop is harvested in the coming months.

Longer term, the US is due a large crop and cheaper Brazilian supplies could put pressure on global prices. Argentina’s maize harvest is estimated at 5.4% complete as of the end of last week. This is behind 10% this time last year and the 13% average.

Global Soya prices have come under pressure over the past two weeks. Many traders believe that the cuts to the Argentinian soybean production has now been factored into the market and now the focus has turned towards the record Brazilian harvest.

The USDA’s supply and demand report is due later this week. Last months projections have Brazil soybean production at a record 153MT and Argentina at 33MT. We expect there to be further cuts to Argentina’s production going forward, but as stated, this is likely to have been factored into the market.

Brazil’s 2022/2023 soybean harvest is estimated at 70% complete as of the end of last week, 8% from the previous week. At this point last year the harvest was at 75% but the fall is to be expected considering the potential record crop.

However, dry weather conditions seen over the past few months in South America has delayed planting. May is always a difficult month in relation to when new crop soya will arrive in the UK. Cover from April to June 2023 is certainly worth a conversation for Hi Pro Soya users in regards to straights.

Bearish sentiment continues on rapeseed, with the EU crop fairing well. This bearish tone is expected to continue as rapeseed supplies on the continent are forecast to increase. The trade association Coceral now estimated EU + UK rapeseed production at 21.1MT, up from 20.4MT in the December report.